Is your household in financial stress?

Is your household in financial stress, in this article you'll find some tips and tricks to help with your financial wellness during tough times. Financial wellness refers to being in control of your financial life and having the ability to meet current and future needs.

It includes aspects such as that dirty ‘B’ word (budgeting), saving, investing, managing debt, and planning for retirement. It also includes being able to handle unexpected life and financial events, such as job loss or unforeseen expenses.

With high mortgage rates and the high cost of living still weighing on households, it’s no wonder they are feeling increased financial pressures on their day-to-day cash flow.

Not surprisingly many marginalised communities, including LGBTIQ+ people, will become even more vulnerable to financial stress due to various factors.

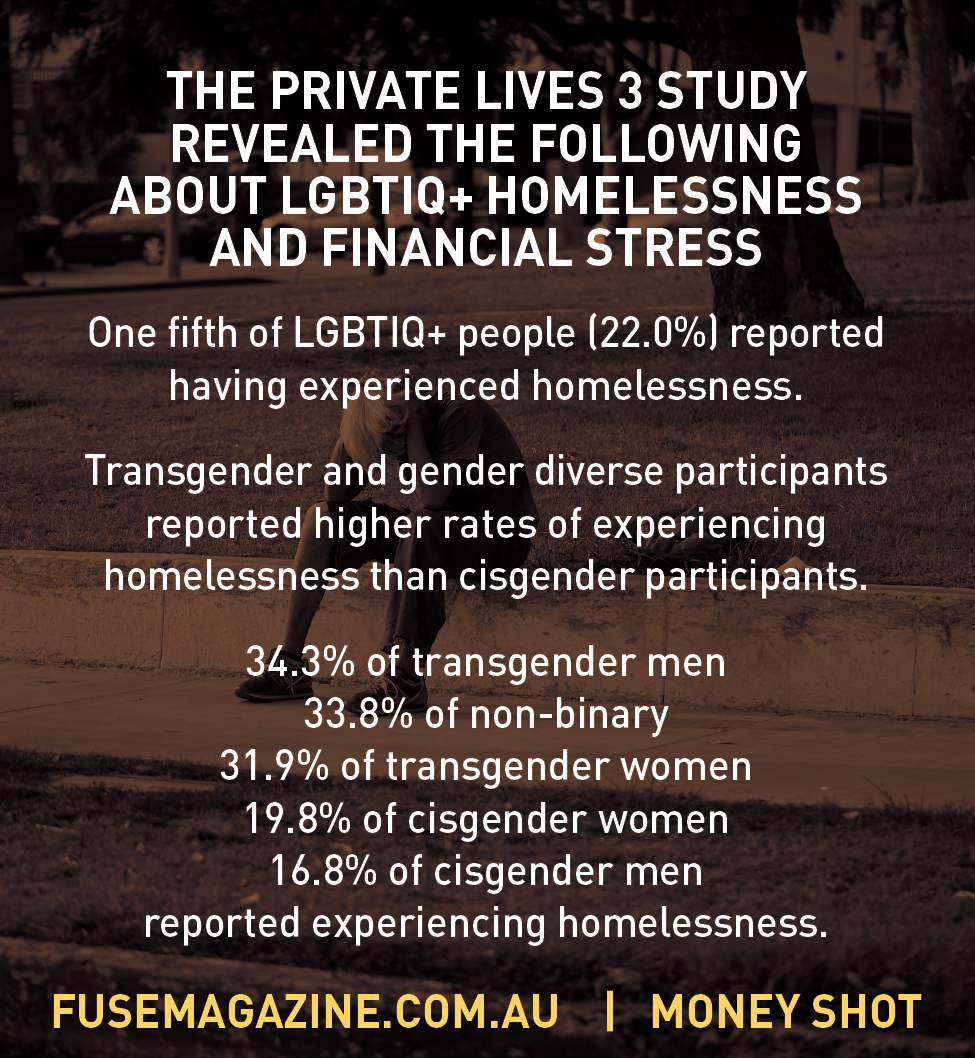

Although most of us are lucky enough to live financially healthy lives, the recent Private.

Lives 3 study from Latrobe University discovered some worrying statistics regarding LGBTIQ+ homelessness and financial stress due to a range of factors, including discrimination in the workplace, higher and unique healthcare costs, and challenges around inheritances and retirement planning.

Even in the lucky country, things can get tough, with a 2022 Australian National University (ANU) study showing that one in four Australians are now finding it difficult to get by on their current income.

Money stresses affect us all in different ways and to varying degrees, but depending on your situation, making a few changes to how you use money can really help you weather difficult times. So what can you do?

HAVE HONEST AND OPEN CHATS ABOUT YOUR SITUATION

Money is all around us but is often a taboo subject! If you’re doing it tough, start by reaching out to friends, family, and financial support services. If you need help, check out your local community service providers.

Many organisations and charities offer free financial counselling and assistance with budgeting. They can also help you with food, emergency accommodation and other resources.

For those of you who are in healthy financial situations, consider donating to organisations that assist others doing it tough.

CONTACT BANK AND SERVICE SUPPLIERS BEFORE YOU GET TOO BEHIND

Remember that banks, most prominent companies, and service providers (internet, power, utilities etc) have hardship teams that are there to help, so if you are not keeping on top of payments, call them early.

HAVE A CASH FLOW PLAN

Yep, that B word. A budget gives you a framework to manage your day-to-day spending habits. Mapping out your weekly needs can help you address cash shortfalls.

BUILD AN EMERGENCY FUND IF YOU CAN

Aim to have 3–6 months of expenses in a cash account. It might seem a lot; however, this will give you a buffer. Start small to build this up over time.

MINDFULNESS AND BEHAVIOUR CHANGE

If you are trying to cut back costs, consider your spending habits. Are you buying a coffee or lunches out every day? Do you put unnecessary items in your shopping trolly? If you want to spend less, you might be surprised at the savings you can make by just changing a few habits.

SOME OTHER QUICK TIPS YOU MIGHT LIKE TO ALSO CONSIDER

- Go grocery shopping on a full stomach — you know why!

- Change to cheaper generic brands where you can.

- Download the Coles and Woollies apps to see their weekly specials on everyday items. Tracking sale items can save you hundreds of dollars over the year.

- Cancel automatic subscriptions and memberships that you don’t use.

- Skip the coffee shop and bring your own lunch to work.

- Have friends over for dinner instead of eating out.

- Set a strict budget if you go out on the town.

- Consider refinancing loans and ditching credit cards with high interest rates and fees.

- Try lowering your energy bill by turning off power sucking devices you’re not using.

- Renegotiate with your utility and service providers, or find cheaper ones.

- Check if you’re paying too much for private health coverage and cull any options you don’t need.

- Speak to an independent financial counsellor.

If you need assistance in exploring these further talk to a professional but most importantly start your journey to being free around your money and creating wealth with understanding.

Scott Malcolm is Director of Money Mechanics a fee-for-service business who are authorised to provide financial advice through PATRON Financial Advice AFSL 307379. For more information email This email address is being protected from spambots. You need JavaScript enabled to view it. or call 1300 772 643. The information provided in this article is of a general nature only. It has been prepared without taking into account your objectives, financial situation or needs. Before acting on this information, you should consider its appropriateness having regard to your own financial goals, objectives and personal circumstances.